Herbal Cigarette Market 2025: Trends, Innovations, and Growth Opportunities in a Smoke-Free Future

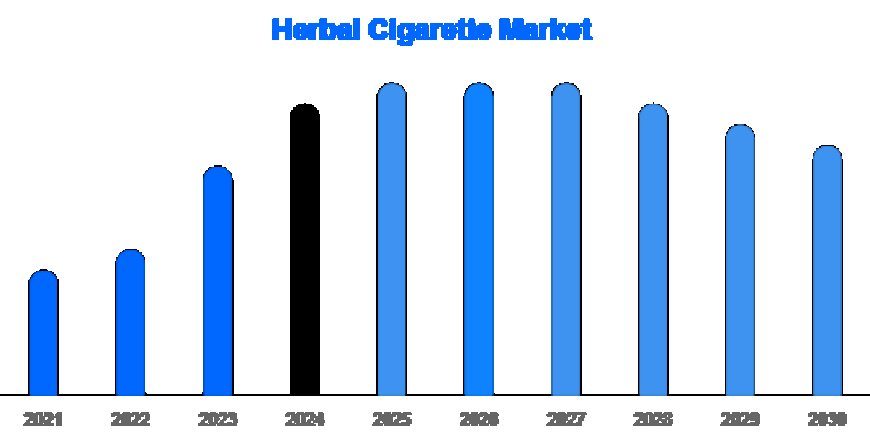

The global herbal cigarette market size was valued at USD 2.1 billion in 2024 and is projected to grow to USD 2.3 billion in 2025, reaching USD 3.2 billion by 2030.

The globalherbal cigarette markethas been steadily gaining momentum as health-conscious consumers shift away from conventional tobacco products toward safer alternatives. Unlike traditional cigarettes, these products are made from herbs such as mint, cinnamon, clove, lemongrass, and green teafree from tobacco, nicotine, and tar. The rising demand for natural and organic products, coupled with legislative restrictions on tobacco, fuels the herbal cigarette market's growth.

In202425, the market is estimated to be worthUSD 23 billion, with a compound annual growth rate (CAGR) of8.9%, driven by product innovation, e-commerce expansion, and enhanced marketing efforts targeting wellness-oriented consumers.

Latest Trends

1. Health & Wellness Positioning

Manufacturers are aggressively marketing herbal cigarettes as healthier alternatives, leveraging clean-label claims, organic ingredients, and eco-friendly packaging. CBD- and THC-infused herbal options have also emerged, tapping into broader wellness trendsespecially in markets where CBD is legal.

2. Flavor Diversification

To cater to evolving preferences, manufacturers are rolling out exotic and customizable flavor blends: berry mint, honey-lemon-ginger, cardamom-spice, and even seasonal flavors. This strategy is helping brands differentiate and appeal to younger adult consumers.

3. Premium & Artisanal Lines

Theres increased interest in small-batch, premium herbal cigarettes made from single-origin herbs with attractive artisan packagingtargeting consumers willing to pay a premium for perceived quality.

4. Digital & D2C Channels

Brands are doubling down on direct-to-consumer (D2C) websites, subscription models, and partnerships with online wellness marketplaces. This trend helps reduce dependency on traditional tobacco retailers and facilitates tighter brand-consumer relationships.

Challenges Facing the Market

Regulatory Ambiguity

While herbal cigarettes escape many tobacco regulations, certain countries still impose restrictions due to combustion concerns. In some regions, they fall under the same legal framework as tobacco, leading to inconsistent labeling and tax policies. Regulatory uncertainty impedes wider market penetration.

Perception vs. Reality

Although promoted as safer, herbal cigarettes still involve smoke inhalation, which may pose risks. Public health organizations often caution consumers against equating herbal with harmlesspotentially dampening demand if awareness increases.

Ingredient Standardization & Quality Control

With diverse herbal sources, maintaining consistent quality and safetyespecially concerning contaminants like pesticides and moldis complex. Manufacturers need stringent supply chain controls and certifications (e.g., USDA organic).

Competition from Alternatives

Health-conscious consumers are increasingly choosing alternatives like nicotine pouches, gums, or nicotine-free vaporizersreducing the appeal of herbal cigarettes. Plus, regulations on flavored smokeable products may further constrain the market.

Opportunities Ahead

Geographic Expansion

Theres strong untapped potential in regions like Latin America, Southeast Asia, and Africa, where traditional tobacco rates are declining. Local manufacturers can adapt herbal blends to regional herbal traditions, creating compelling niche products.

Functional & Infused Products

Incorporating active botanicals (e.g., adaptogens like ashwagandha, calming chamomile) and CBD/THC infusions presents avenues for innovation. Regulatory clarity in key markets (e.g., parts of Europe and North America) will boost this segments growth.

Sustainability & Transparency Focus

Prioritizing organic, fair-trade herbs, biodegradable filters, and carbon-neutral manufacturing can attract eco-conscious consumers and justify premium pricing while boosting brand integrity.

Segment Overview

To simplify market segmentation, well refer to three distinct categoriesA,B, andCbased on ingredients and positioning:

A. Traditional Herbal Blends

This includes long-established blends such as mint, clove, cinnamon, and menthol. Characterized by mass-market appeal and wide availability, this segment constitutes~6065% of global volume. Brands likeSmokingandHoneyrosedominate here, with strong retail presence.

B. Premium & Specialty Blends

These are artisanal, small-batch herbal cigarettes using exotic herbs from specialized regions. They typically carry higher price points and are popular among niche consumers seeking unique flavor experiences. This segment comprises~20% of the marketand is experiencing the fastest growth, currently at1012% CAGR.

C. Functional & Infused Products

This emerging category features herbal cigarettes infused with CBD, adaptogens, or botanicals like chamomile and lavender to offer wellness benefits. Although still in early stages, it's growing rapidly~810% CAGRand holds around1518%of current market value.

Top Players: Recent Developments

Here is a snapshot of the major companies in the herbal cigarette market and their key activities:

1. Smoking (Deutschland GmbH)

-

2024: Launched a new line ofCBD-infused herbal cigarettesin Germany and Austria, tapping into wellness trends.

-

2025: Invested in carbon-neutral packaging and announced partnerships with sustainable agriculture groups in India.

2. Honeyrose (Italy)

-

2024: Expanded into Southeast Asia with mint and clove variants, launched premium artisan line Honeyrose Exclusive, sourced from Sicilian-grown herbs.

-

2025: Announced merger talks with a regional distributor in Vietnam to strengthen Southeast Asian penetration.

3. Quest International (Canada)

-

2024: Debuted herbal cigarettes infused with Canadian-grown chamomile and lavender; rebranded under the wellness-oriented sub-brand TranquilPuff.

-

2025: Signed M&A agreement to acquire local herbal blend producer in BC, Canada, enhancing domestic sourcing.

4. Odorless & Smokeless (USA)

-

2024: Introduced an odorless herbal product line marketed to indoor-use consumers.

-

2025: Completed a private equity investment round (~US?$10 million) aimed at scaling North American distribution and developing new functional blends.

Regulatory & Legislative Watch

-

European Unionis reviewing legislation on flavored smokeables; if herbal cigarettes are swept in with flavored tobacco bans, it may disrupt flavored-market segments.

-

India(Maharashtra) and other states are tracking herbal products closelysome pilot bans and health warnings imposed despite no nicotine content.

Conclusion

Theherbal cigarette marketremains dynamic and poised for continued growth, driven by health-conscious trends, innovative infusions, and premium offerings. Regulatory uncertainties and public health perceptions remain notable challenges. However, market participants that invest in product differentiationvia unique blends, sustainability, wellness-infused offerings, and digital strategiesare best placed to capitalize on emerging opportunities, especially in untapped geographies and premium niches.

About Us

Deep Market Insightsis a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Deep Market Insights provides actionable market research data, especially designed and presented for decision making and ROI.

Most Asked FAQs

1. Are herbal cigarettes truly safer than tobacco cigarettes?

Herbal cigarettes eliminate tobacco and nicotine, but they still involve inhaling burnt plant material, which can irritate lungs. They are often perceived as safer, but they are not risk-free.

2. Do herbal cigarettes contain nicotine?

No. By definition, herbal cigarettes are nicotine- and tobacco-free. However, some functional blends may include CBD or THC if legally permitted.

3. Can I buy herbal cigarettes online?

Yesmany companies sell via direct-to-consumer websites and subscriptions. Availability depends on local laws and import regulations.